Blogs

ICBC (step three.00% p.a. having the absolute minimum deposit away from $five hundred for three months) plus the Financial out of China (step 3.00% p.a. that have at least put of $five hundred for three months) are perfect options for small put quantity and small-time frames. You to great thing I really like in regards to the DBS repaired deposit prices is their lowest lowest put level of $step one,one hundred thousand. If you’re able to simply afford to lock in your hard earned money to possess less than one year, DBS will let you choose any put several months at the one-few days periods, from one to help you one year. If you’lso are trying to deposit lower amounts of one’s offers to your an excellent fixed deposit account, CIMB’s board costs try a good measly 0.2 % to 0.step 3 % p.an excellent. ICBC is an excellent selection for short deposit amounts and you will brief day frames, at the 3.35 per cent p.an excellent. That’s a short partnership months, but nonetheless a big sum of money.

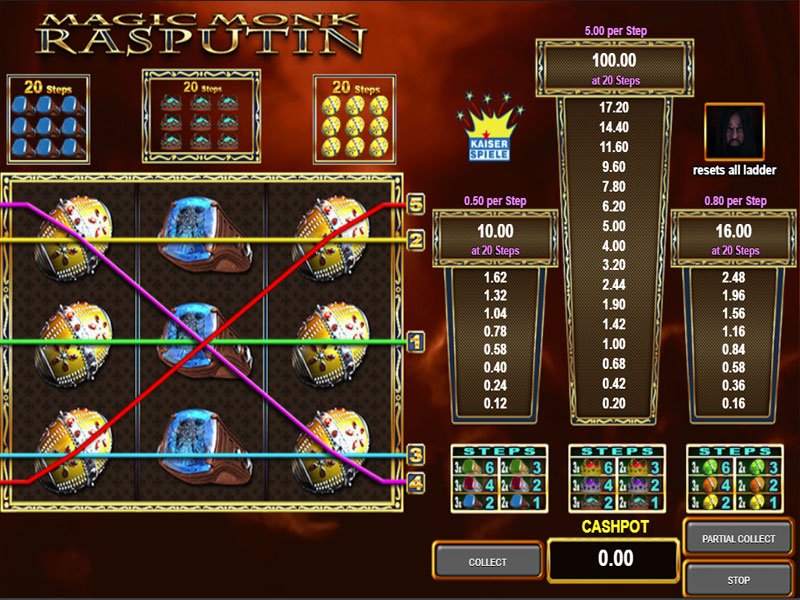

Player is required to generate a real-currency put very first (whether or not is really as nothing because the a good $5 from the a good $5 lowest deposit local casino). Ahead of withdrawing, you should satisfy betting criteria tied to their added bonus money. Be sure to seek any conditions to your wagering standards.

For example, an driver get allow you to choice only $5 at once when using $50 within the bonus finance otherwise to play for the wagering criteria. A no-deposit bonus can be used to play real money gambling games in every managed You state (New jersey, MI, PA, WV, CT, DE, RI). For many who victory any money to play the individuals online game, it’s your own personal to help you cash-out after you have met one playthrough criteria. The brand new detachment away from fund symbolizing such as Honors of a player Membership was subject to the newest conditions and you will criteria for the Contract.

A number of our subscribers particularly wanted information about FDIC insurance coverage limitations to have bank dumps belonging to trusts. The clear answer depends on of several items, including the type of faith (revocable otherwise irrevocable), what number of additional info beneficiaries, as well as the kind of attention for each recipient retains regarding the believe. Fortunately, the brand new FDIC acknowledged the need to clarify exactly how insurance policies try calculated to have trust accounts, and you may the new legislation goes to the impact on April 1. Dumps insured to the a solution-thanks to foundation try added to any places that the owner retains in the same deposit insurance class in one bank to possess purposes of the new deposit insurance coverage limitation. A trust holder is pick as many beneficiaries while they such as; although not, for put insurance intentions, a believe membership owner one describes five or more qualified beneficiaries will never be covered beyond $step 1,250,one hundred thousand for each and every lender. Inside calculating visibility, a recipient only counts after for each manager, even if the exact same recipient is included many times on the trust account in one financial.

The only path an excellent Maybank repaired put might possibly be beneficial is if you might also need chose Maybank offers membership otherwise newest profile and will make use of Maybank’s deposit bundle campaign. Per $step 1,100000 on the membership (minimum of $dos,000), you can put currency (inside the categories of $ten,000; minimum $20,000) on the put bundle and revel in special-interest costs away from step 3.thirty-five percent p.a. HSBC’s repaired deposit costs are presently the best to possess an excellent three-week connection several months, at 3.fifty per cent p.a. That’s one of several large fixed put prices that it few days, and a pretty small period as well. HSBC’s repaired deposit is additionally useful since the rather than financial institutions such CIMB, your don’t need to be a favorite customers to enjoy which rate.

It’s taken a huge hit as the last year, if this is actually giving around step 3.8%. Nevertheless, 3% is one of the high rates it day on the our very own checklist. As the finance is actually invested, I’d want to let them compound so long as you’ll be able to. If we features a major scientific costs, I can decide to buy all of them with all of our HSA savings if required.

Following definitely here are a few all incredible brands out of roulette you can enjoy during the Zodiac Gambling establishment. Zodiac Casino doesn’t accept players outside the United kingdom for the your website. Do look at StashAway’s Simple Secured page to your current costs. Manage read the Syfe Dollars+ Secured page to the current prices. You could stop income tax issues with your HSA by professional-get your efforts.

The brand new Host Ensure coverage is a thing all of the Airbnb machine homeowner might be accustomed. Dependant on the type of assets you’re providing, for many who ensure it is dogs, etc., billing a safety deposit could add an additional amount of defense to suit your possessions, is to anything uncommon can be found. Ensure your entire possessions and personal accountability insurance is additionally high tech, because this can also help in order to decrease one losings. For individuals who’re looking for a close exposure-100 percent free money auto, you’re bound to came around the fixed deposits, Singapore Savings Bonds (SSB) and you may Treasury expenses (T-bills). Advertising and marketing costs legitimate from 10 Mar 2025, subject to change each time by CIMB. The brand new costs above have been set on ten Mar 2025 and are subject to changes at any time by Bank from China.

To possess the very least put level of $50,100000 and you can a connection age of step three or half a year. That’s down from the 0.10% since their marketing cost inside the Feb 2025. Since the FDIC changes the insurance restrictions, it’s crucial for financial consumers, for example people with faith accounts, understand the brand new ramifications and take proactive actions to make sure its places is actually completely secure. From the staying advised and you will examining possibilities, depositors can also be browse these transform effectively if you are shielding its financial assets. The fresh FDIC’s the newest standards to possess put insurance policies, active April step 1, will get lower exposure limitations to own financial people which have faith accounts. While you are designed to improve insurance policies regulations, such change you are going to unwittingly push certain depositors more than FDIC restrictions, centered on skillfully developed.